Customisation in ERPNext: Implementing Electronic-Invoicing Compliance for ERPNext in Argentina

By Mukesh Variyani March 25, 2025 Business

ERPNext is a versatile open-source ERP system that allows businesses to manage various operations efficiently. Implementing electronic-invoicing compliance in ERPNext ensures seamless integration with government tax regulations. It automates invoice generation, validation, and real-time reporting to tax authorities. This customization reduces manual errors, enhances accuracy, and streamlines financial operations. Businesses benefit from improved efficiency and compliance with legal standards.

Custom Fields to Support Legal Compliance

To ensure seamless electronic-invoicing compliance within ERPNext, custom fields are introduced to meet regulatory requirements and facilitate tax reporting.

Electronic Invoicing Requirements:

Dedicated fields to generate the CAE (Authorization Code) and track its expiration date for each invoice.

VAT Compliance:

Custom fields to manage VAT statuses for both customers and the company, ensuring compliance with local tax regulations.

Payment Processing:

Support for multiple payment methods, including bank transfers, credit/debit cards, and digital wallets.

Tax Status Management:

Customer-specific tax identification fields to accommodate different tax categories, such as exempt, general, and reduced VAT rates.

Enhanced Form Organization

To improve user experience and ensure a structured layout, form enhancements are implemented in ERPNext:

Tab Breaks:

Grouping electronic invoicing fields into logical sections to enhance navigation and user efficiency.

Column Breaks:

Optimizing field placement for better readability and workflow organization.

Predefined Select Fields:

Standardized dropdown options for VAT statuses, payment methods, and tax categories to reduce manual errors and ensure consistency.

Process Flow for Sales Invoice with Electronic-Invoice Generation

A streamlined process flow is established to integrate electronic-invoicing into the sales invoice workflow:

Here's a quick video demonstrating the process flow integrating Electronic-Invoice into the sales invoice:

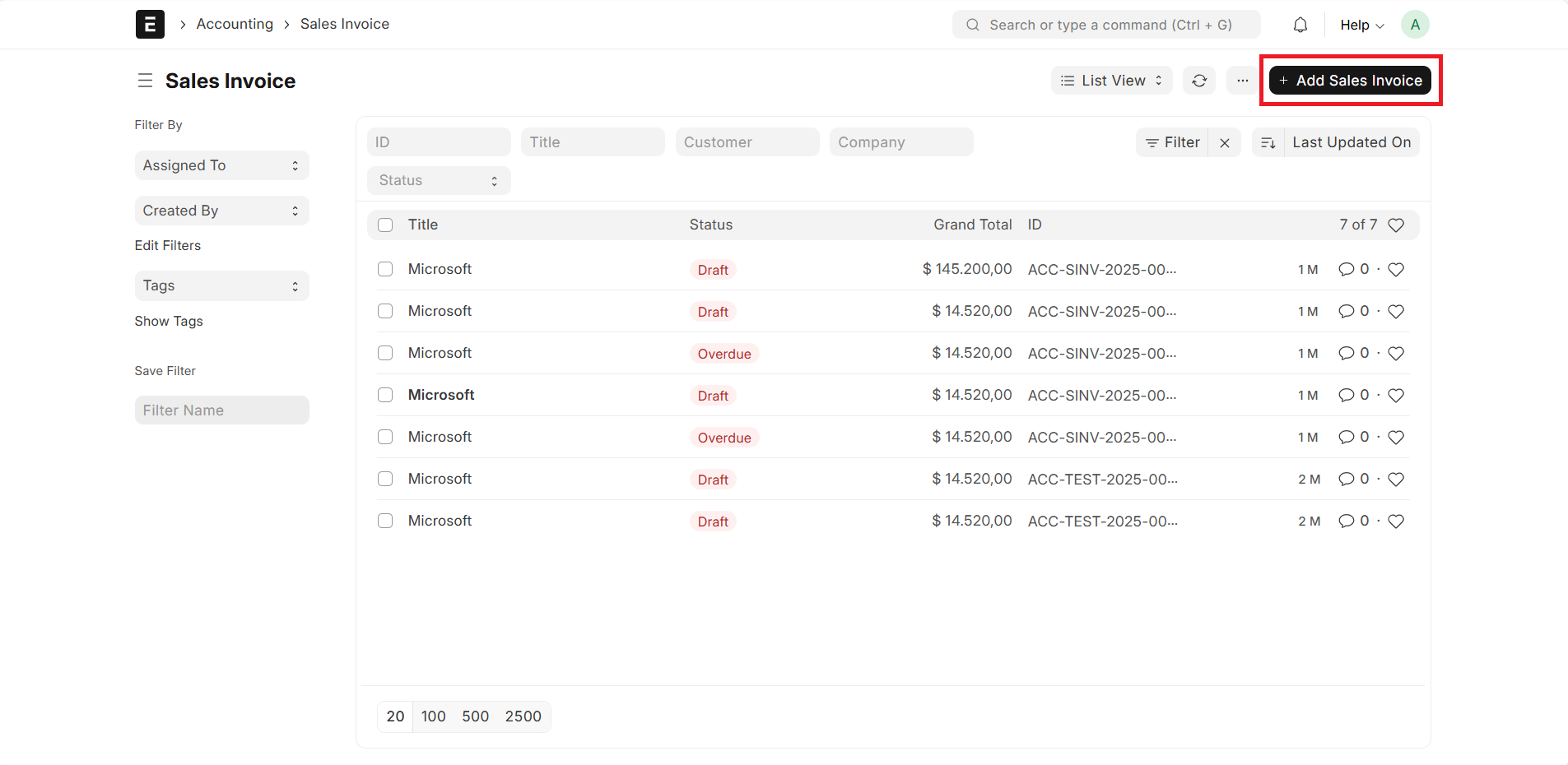

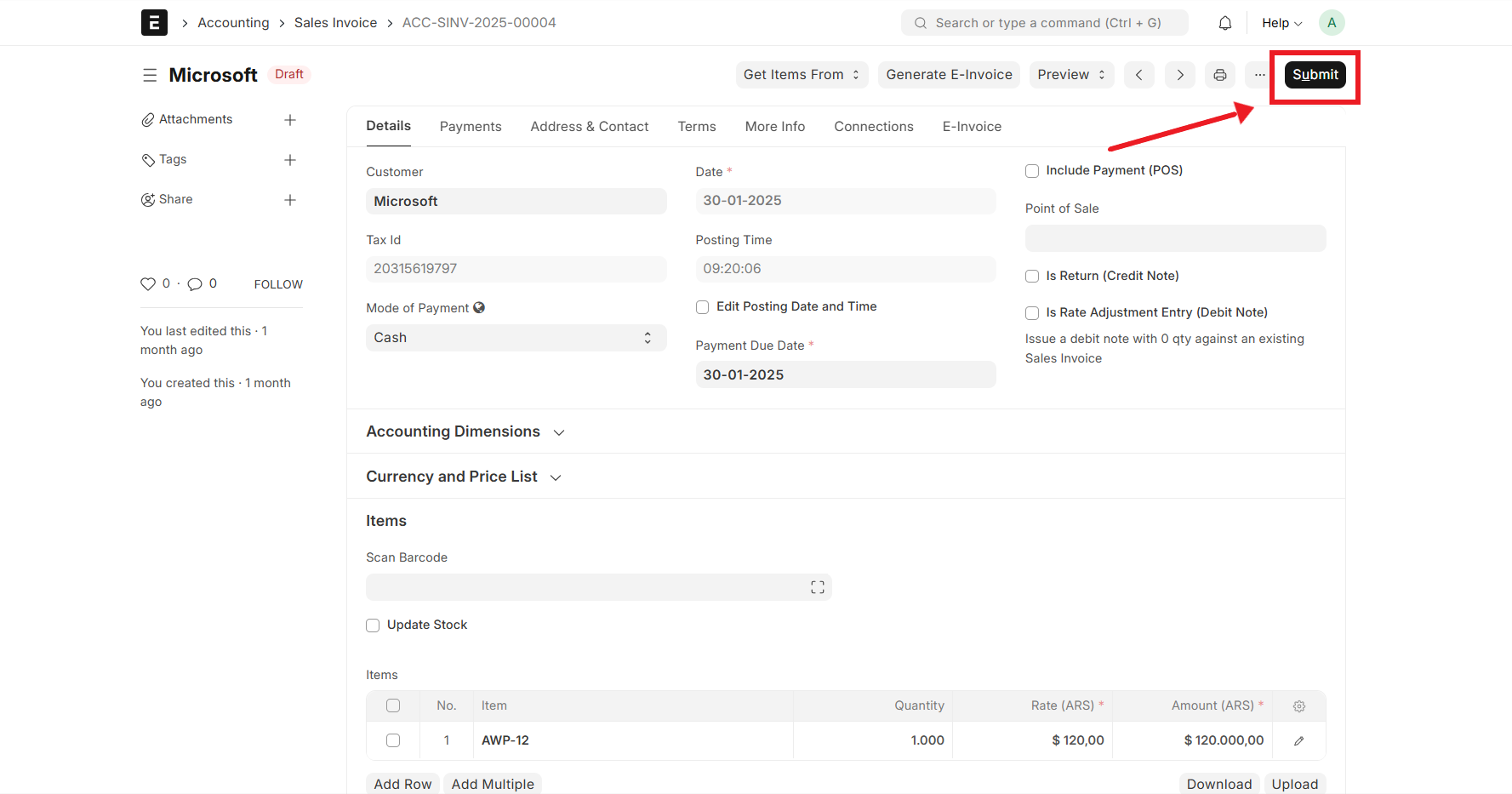

Step 1: Create and Save Sales Invoice:

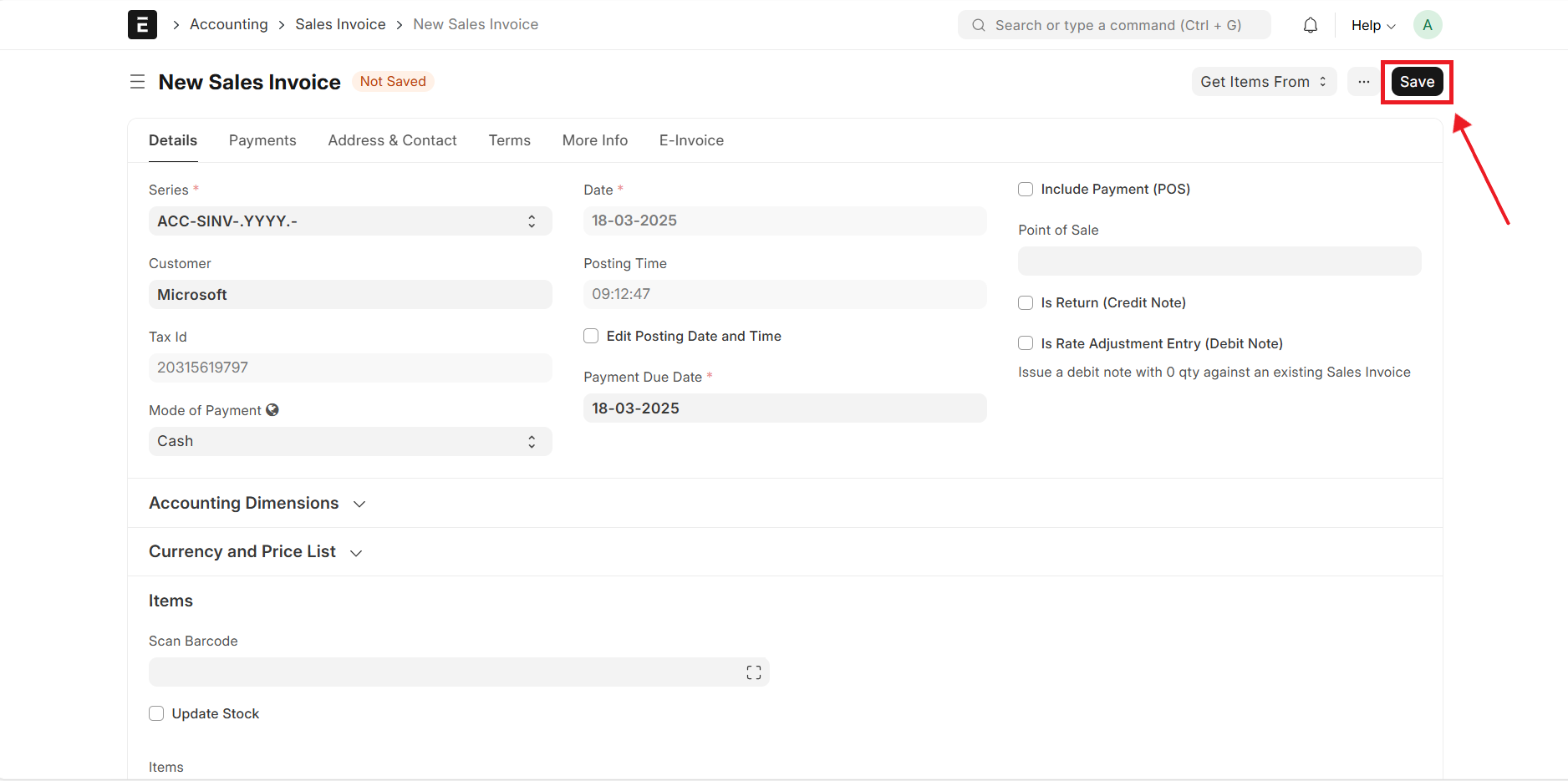

Enter customer, item, and payment details, ensuring accuracy before saving as a draft.

Step 2: Final Edits and Save:

Make necessary corrections and updates, then save the invoice for validation.

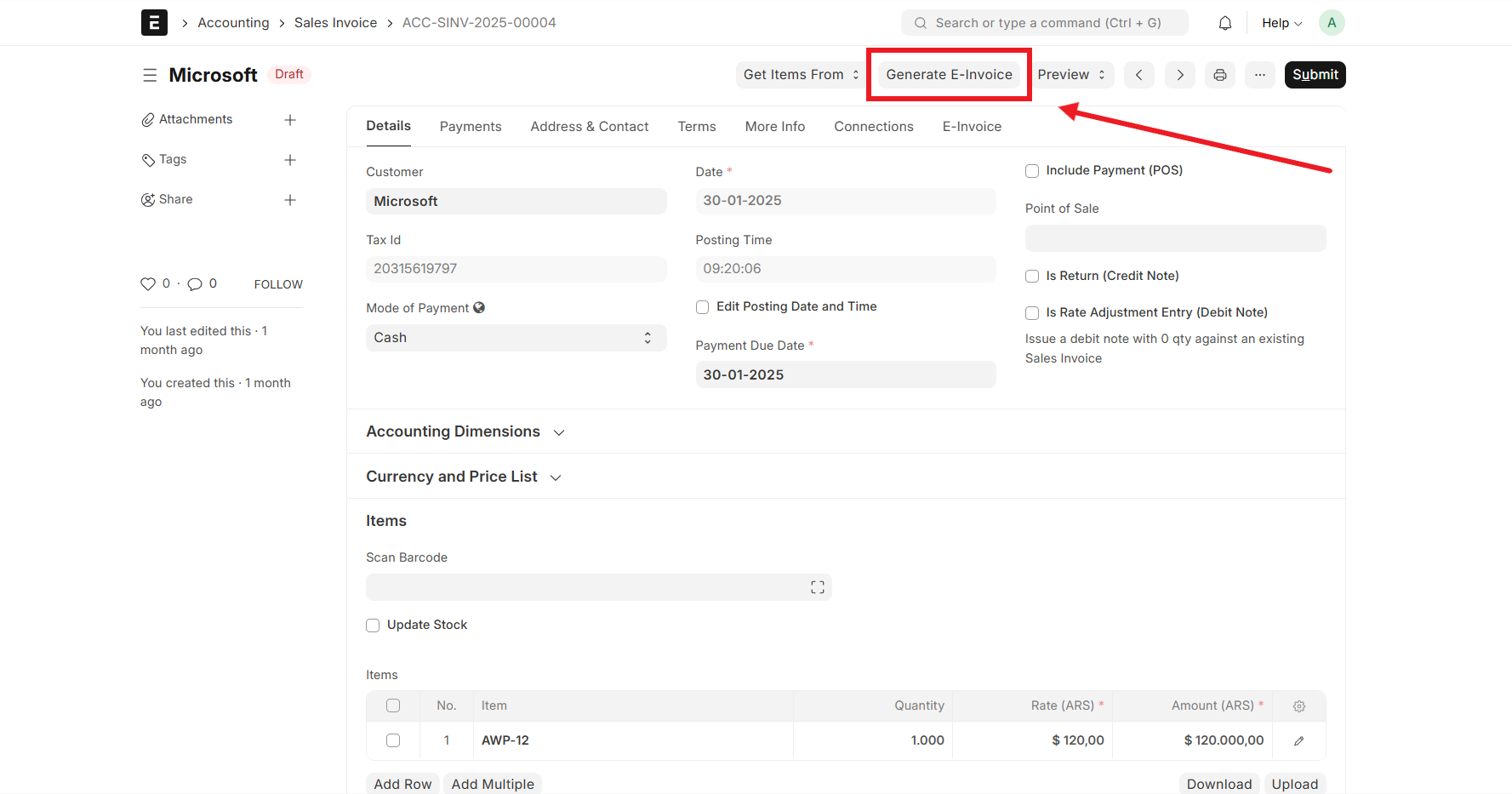

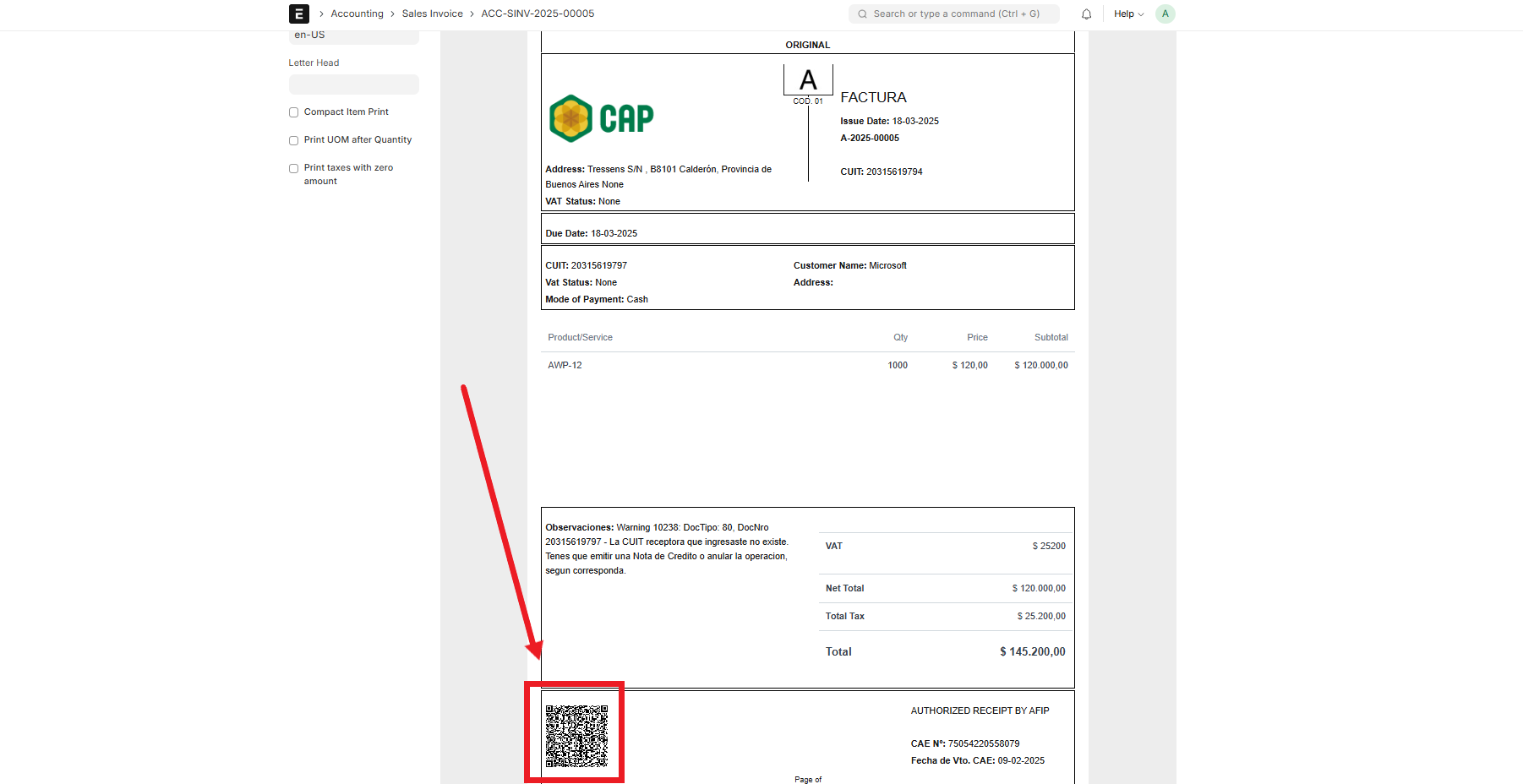

Step 3: Generate Electronic-Invoice:

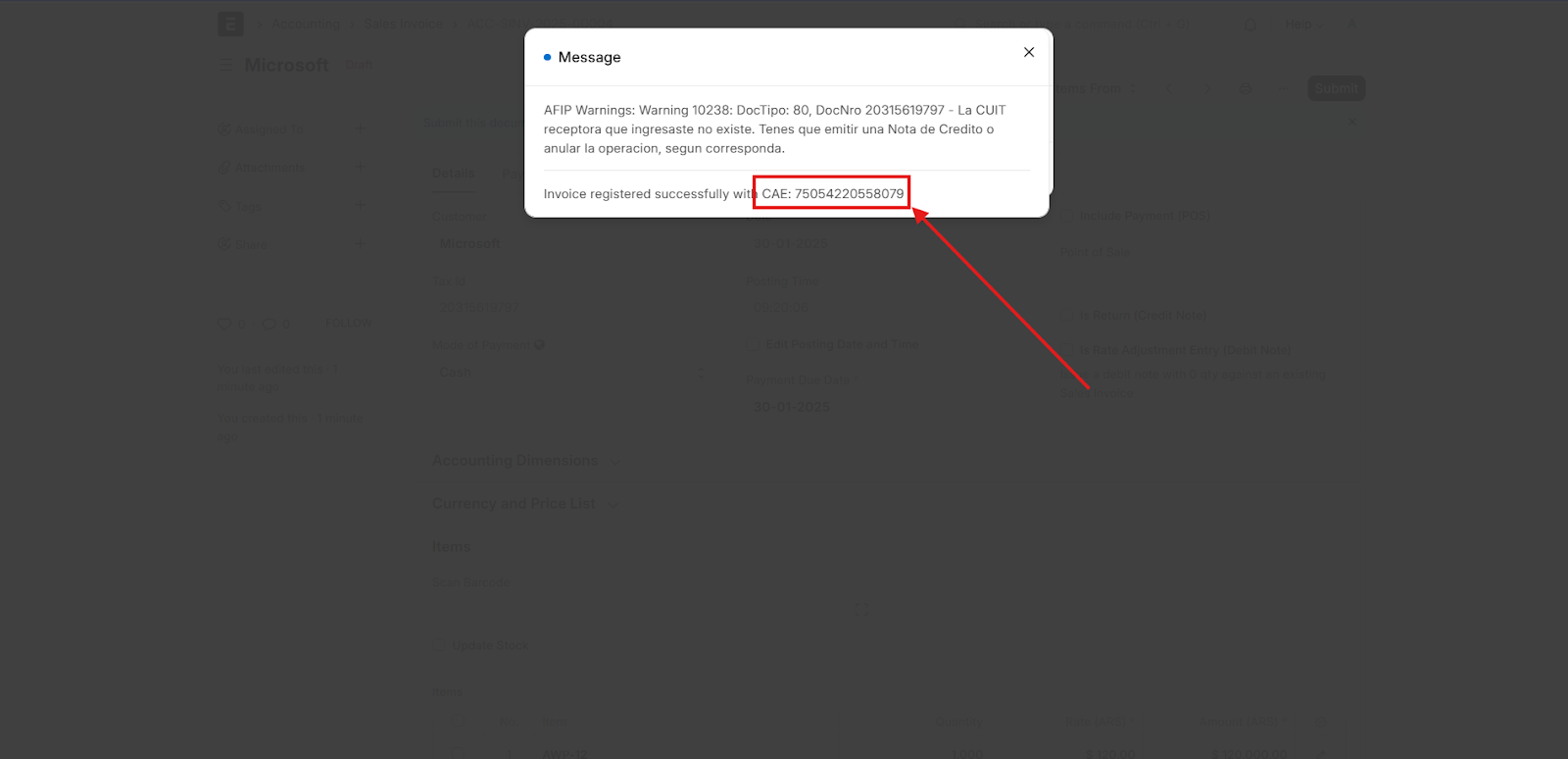

Communicate with the tax authority for validation and authorization. Retrieve the CAE (Authorization Code) and expiration date.

Step 4: Submit Sales Invoice:

Finalize and submit the invoice after successful Electronic-Invoice generation.

Step 5: QR Code:

Embed a QR code on the invoice, enabling instant verification by tax authorities and customers.

Support for Various Business Scenarios

ERPNext customizations cater to different business models and regulatory requirements:

Multi-Payment Method Handling:

Enable businesses to process payments through diverse channels like cash, bank transfers, credit cards, and online payment gateways.

Multi-VAT Status Management:

Assign appropriate VAT rates and exemptions based on customer and product categories.

How We Can Help Companies in Argentina

Our tailored ERPNext localization solution ensures businesses can seamlessly comply with Argentina's electronic-invoicing regulations while enhancing operational efficiency. Here's how we assist:

Compliance with AFIP Regulations

Integration with AFIP's electronic-invoicing API to validate and authorize invoices.Automatic generation of CAE and management of its expiration dates.

Streamlined Invoicing Process

Elimination of manual processes by automating invoice validation and submission. Reduction in errors with predefined options and enhanced form organization.

End-to-End Implementation Support

Customization of ERPNext to include all required fields and features. Comprehensive training and documentation to ensure smooth adoption. Ongoing support for maintenance and future updates as regulations evolve.

Scalable and Cost-Effective Solution

Leveraging open-source ERPNext minimizes software licensing costs. Modular design allows scalability as businesses grow.

Conclusion

Implementing electronic-invoicing compliance in ERPNext streamlines tax reporting, reduces manual errors, and enhances regulatory adherence. With custom fields, optimized workflows, and security enhancements, businesses can ensure seamless, accurate, and legally compliant invoicing.ERP for chemical business to work with your convinience. Know more about our ERP Software and ERP Implementation Services.

Mukesh Variyani

MD, Finbyz Tech Pvt Ltd