Investment Portfolio Management in ERPNext

Discover how ERPNext empowers you to seamlessly track and optimize your financial assets. Manage stocks, bonds, mutual funds, and more with a unified dashboard for insightful decision-making.

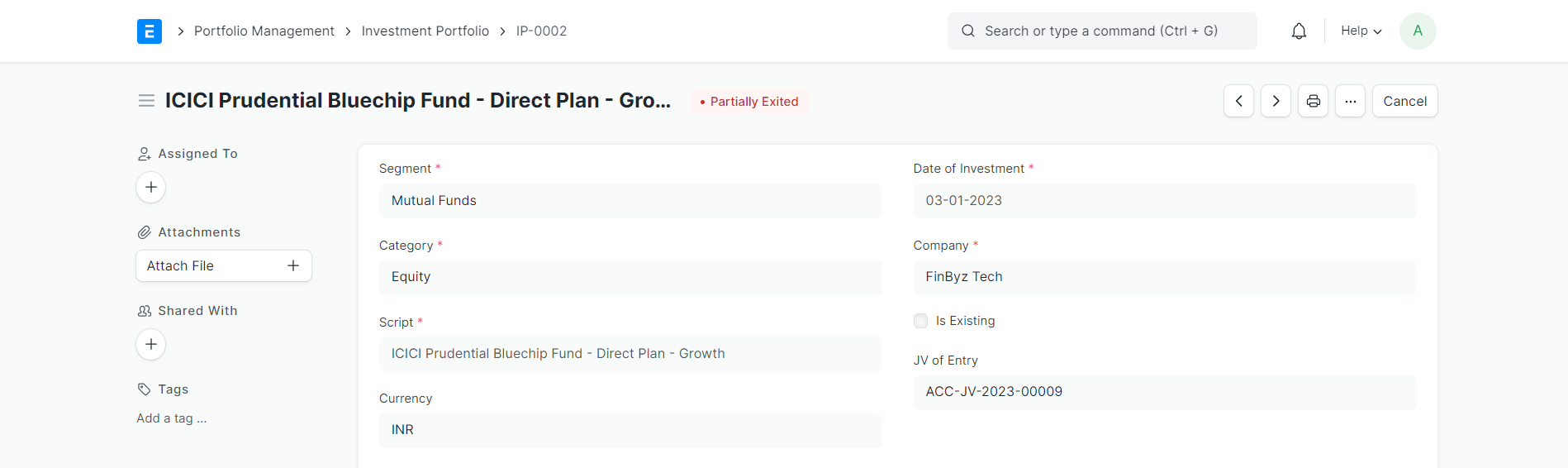

ERPNext Investment Management empowers you to seamlessly track and manage your financial assets in one place. From stocks and bonds to mutual funds, equity, and ETFs, this portfolio overview ERPNext solution simplifies your investment tracking and provides a unified dashboard for insightful decision-making.

How to Use ERPNext Investment Portfolio

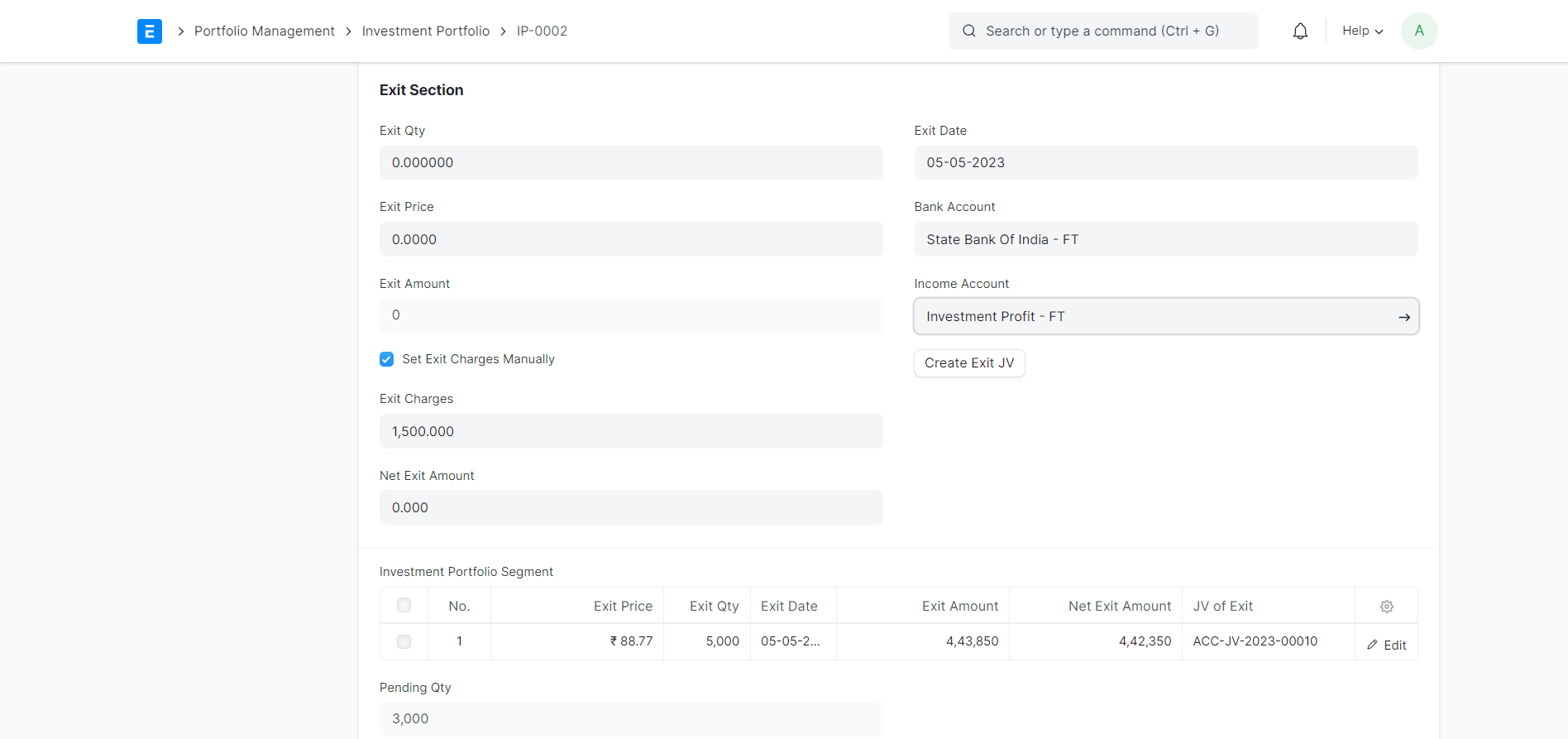

Exit Process of Investment Portfolio in ERPNext

Key Benefits of ERPNext Investment Portfolio Management

Unified dashboard for all investment types

Automated journal entries for transactions

Flexible configuration for accounts and charges

Real-time status updates (Holding, Exited, Partially Exited)

Supports multiple partial exits and existing portfolios

Streamlined tracking and reporting for better decision-making

Transform Your Investment Portfolio Management

Experience seamless, automated, and insightful investment tracking with ERPNext. Contact us to get started or request a demo today.

Frequently Asked Questions

Find answers to common questions about our services

Still have questions?

Contact Support