How to Define Item-Wise Tax Rates in ERPNext

How to Define Item-Wise Tax Rates in ERPNext

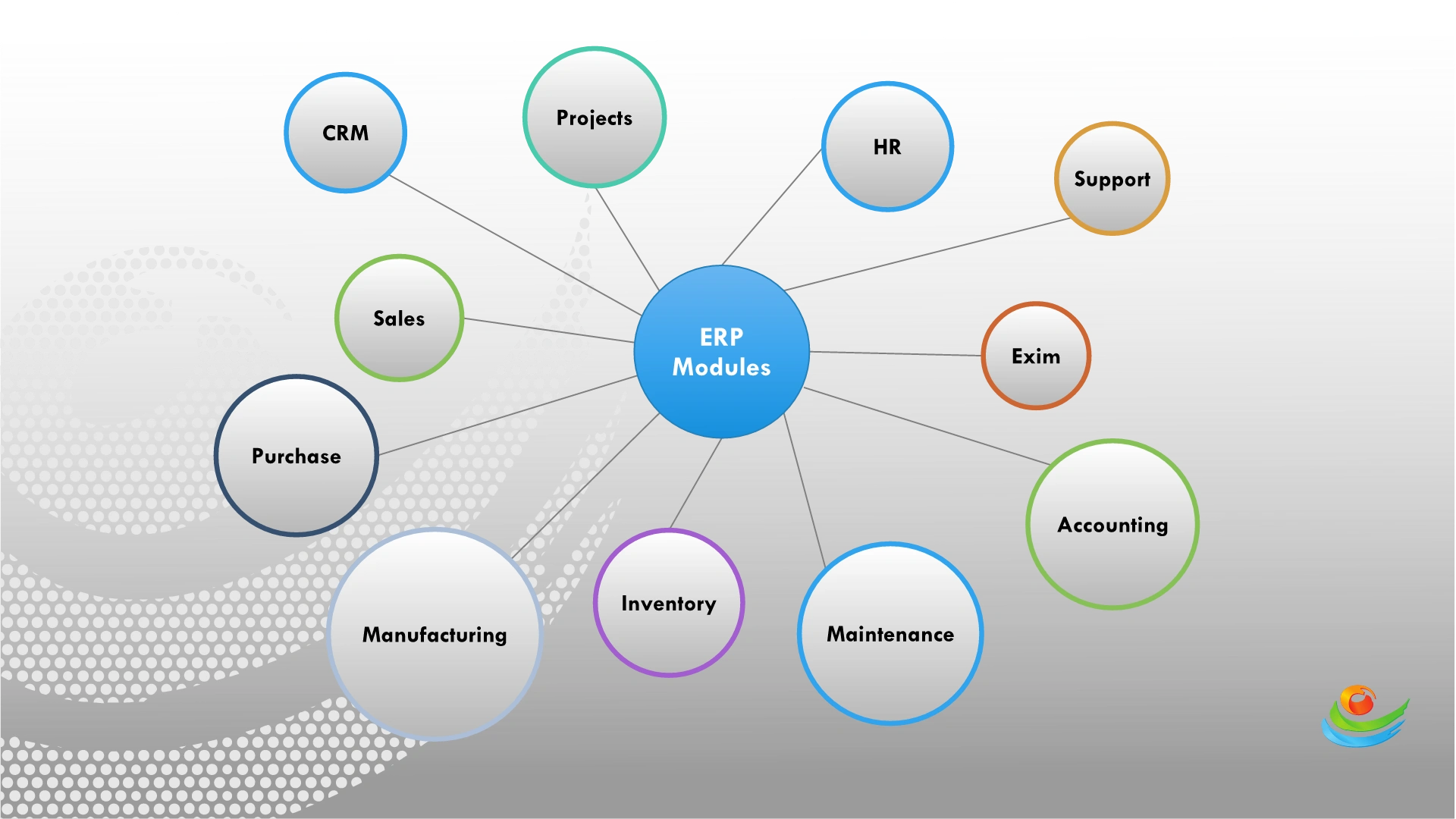

ERPNext is a powerful Enterprise Resource Planning (ERP) software that helps streamline business operations one of the most important being configuring taxes in ERPNext for accurate financial reporting and regulatory compliance. One effective method is setting up item-level tax configurations using the Item tax template ERPNext feature.

Step 1: Log In to ERPNext

Begin by logging into your ERPNext account using your credentials. Ensure your user role has permissions to manage item-level configurations, including tax rates.

Step 2: Access the Item List

Navigate to the "Item List" by selecting "Items" from the main menu. This section displays all your existing products and services.

Step 3: Select the Item

Click on the specific item for which you wish to define individual tax rates. This will open the item's detailed record.

Step 4: Edit the Item

On the item’s detail page, click the “Edit” button to make changes. This will allow you to manage fields related to pricing, inventory, and taxation.

Step 5: Define Tax Rates

Scroll to the "Tax" section. If you are managing multiple items with similar tax rules, it is recommended to use the Item tax template in ERPNext for consistency and scalability. However, you can still manually define item-wise tax rates here.

Step 6: Add Tax Rate Details

When configuring the taxes for this item, include the following:

Tax Type: Select the applicable tax (e.g., GST, VAT).

Tax Rate: Enter the percentage (e.g., 5%, 18%).

Tax Account: Choose the correct ledger/account for tax tracking and reporting.

Step 7: Save Changes

Once the tax configuration is completed, click “Save”. Your changes will now be reflected in the item’s tax setup.

Step 8: Review and Test

To ensure that your item-wise tax rates are correctly applied, create test sales or purchase entries. ERPNext should automatically pull the configured tax values.

Step 9: Repeat for Other Items

Repeat this process or apply an Item tax template ERPNext to efficiently define tax rates for a group of similar items.

Step 10: Monitor and Update

Keep your item tax setup aligned with the latest tax rules. Regularly audit and update the defined tax rates or templates when there are changes in tax laws or item classifications.

By effectively configuring taxes in ERPNext using the Item Tax Template, you ensure accurate and compliant tax handling across your item catalog. Proper configuration of tax rates improves financial transparency and simplifies tax filing processes.

Frequently Asked Questions

Find answers to common questions about our services

Still have questions?

Contact Support

.webp)

.gif)